The Simplest Way to Leave a Legacy

An individual retirement account (IRA) is a tax-advantaged retirement savings account. There are a few different types of IRA accounts,...

February 15, 2023

February 17, 2021

We’d like to let you in on a charitable giving secret that could increase the value of your donations, while costing you less money… and lower your tax bill at the same time.

More than 80% of Americans who donate to charity also own stocks or mutual funds –yet only 20% have ever given those assets directly to charity. This is probably because most don’t know how simple it is to donate these securities, or that this strategy can be a “Win-Win” for you and the charities most important to you.

Chances are good that you have a brokerage account that contains stocks, bonds, exchange-traded funds (ETFs), or mutual funds you’ve held for more than one year. Like the rest of the stock market, assets like these have almost universally increased in value over the years. Donating these securities directly to Mercy Home allows you to stretch your dollar further than if you’d simply sold the stock and then given cash to charity.

Donating publicly-traded securities is among the most taxadvantaged ways to support the kids at Mercy Home. The reason is simple: these gifts allow you to avoid capital gains taxes, which can be as high as 20% on long-term holdings.

If you have any money in the market, you’ve likely seen some terrific gains in the past 5, 10, or 20 years. These assets grow tax-free while invested, but come with a hefty bill when sold. If instead you donated the stock directly to Mercy Home, you would avoid capital gains tax completely on the gifted shares.

Plus, you are still eligible to deduct this gift of stock from your income taxes for the year in which the donation is made. If you itemize deductions on your tax return, you may claim a charitable deduction for the full fair-market value of the donated securities.

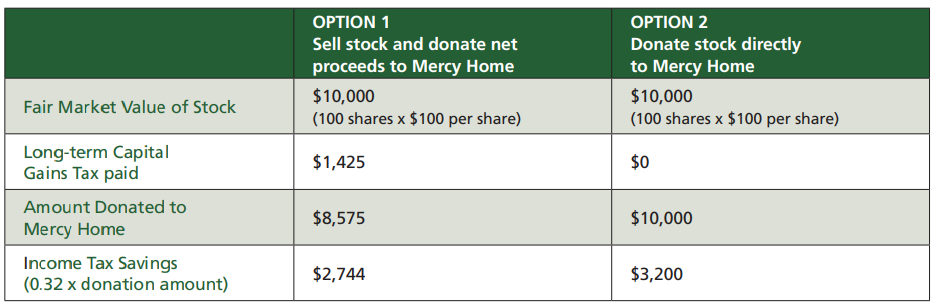

Below is an example to help you decide if donating appreciated investments is a good option for you. Let’s assume that you’re married filing jointly, are in the 32% tax bracket, and want to donate $10,000 worth of stock. In this example, you see that donating the stock results in no capital gains tax being paid and a larger itemized deduction.

An individual retirement account (IRA) is a tax-advantaged retirement savings account. There are a few different types of IRA accounts,...

February 15, 2023

We’ve seen some big changes to Federal Tax Laws in the past few years, and 2023 will continue this trend....

January 31, 2023

You‘ve likely already seen the good news about Mercy Home’s Legacy Challenge (in effect through December 31). The concept is...

July 19, 2022

Comments