Running for Wellness: Youth Tackle Famed Chicago 8K Race

On a recent Sunday morning, a group of our young people and staff ran through Grant Park and the streets...

April 11, 2025

April 23, 2025

As our boys and girls enter adulthood, they will make life-changing decisions. Some will enroll in a four-year college while others enter the workforce and begin raising a family. But what young people might forget is that each of these choices involves a cost.

At Mercy Home for Boys & Girls, we prepare our young people for the future by teaching them about the financial implications that each of their decisions may have both in the near and long term.

“In the education and career resources department, we focus on post-secondary life, but we need to realize there’s a financial piece of it as well,” Gabriel Avalos, Mercy Home’s senior coordinator of post-secondary options & career resources, said. “We want them to develop good spending habits while they’re in our care because the habits they develop when they’re younger are going to carry over into adulthood.”

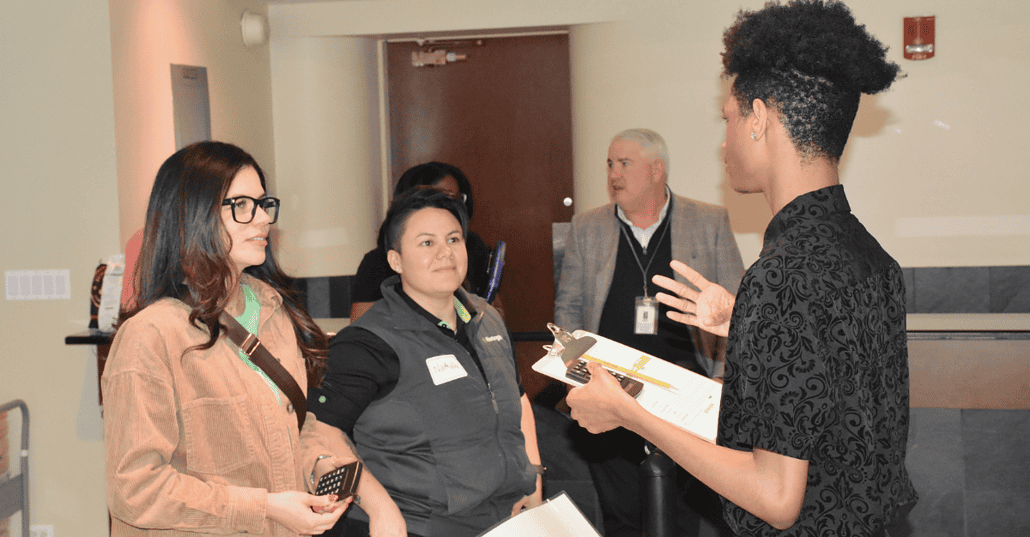

As part of this focus, Mercy Home welcomed Huntington Bank to present to our young people about credit and budgeting before leading a real-life simulation where they were given a mock profession, family size, and credit score to practice navigating life’s costs.

Renee Stetz, a senior regional banking relationship manager at Huntington Bank, said that they decided to bring their interactive program, “Reality Days,” to Mercy Home after providing our young people with Christmas gifts in December.

“We reached out to our colleagues at Huntington Bank and the response was phenomenal,” Stetz, who noted that employees from multiple branches volunteered to attend, said. “An entire retail district raised their hands to come out here and present Reality Days to the children.”

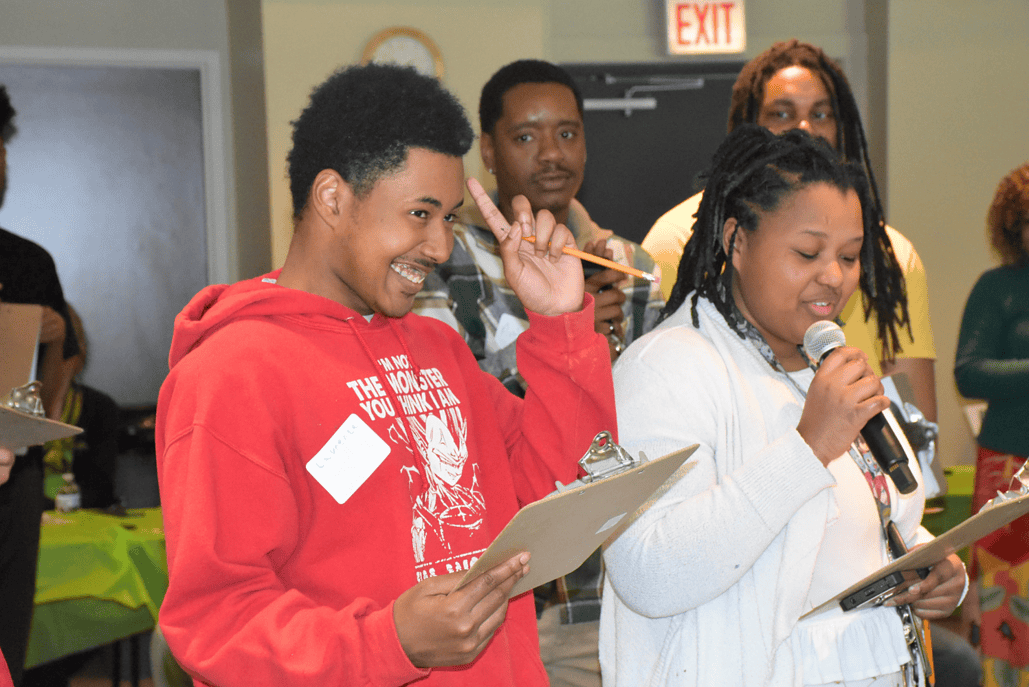

After being given their mock situations, the young people were required to travel to each station led by Huntington Bank volunteers. Equipped with a budget sheet, a pencil, and a calculator, each youth traveled to tables that simulated the experience of paying for things like college, housing, transportation, childcare, food, and more.

“The goal is to prepare people heading out into adulthood on how to handle basic financial needs,” Stetz said. “We want to teach them about checking accounts, how to save, and how to budget. The best thing we can do as a bank is to get young people ready to move forward instead of getting out into the world and not knowing what to do.”

One of our young people, Dylon, ended up losing $1,082 in the activity after having to spend an unexpected chunk of his salary on an emergency room visit.

“This was really an eye opener,” Dylon said. “I learned that if you make $22,000 a year, it’s really hard to survive. And if you have kids, you have to make sure they have food, healthcare, and all types of other costs.”

Through educational opportunities like this one, our youth build a foundation that helps them avoid mistakes and achieve financial security. One young person said that this simulation showed him how costly having children can be while another young person said that they wanted to start saving now.

“Be frugal, invest, and always earn more money,” Damien, a young person in Bernardin Home, said.

While Mercy Home emphasizes the importance of these healthy spending habits, it’s also important for the young people to hear it from professional financial planners in their own community. Throughout the day, the young people had opportunities to speak one-on-one with Huntington Bank employees.

“[My favorite part has been] watching the children light up, interact, and listening to how they rationalize what they’re spending and how they’re spending it,” Stetz said. “I was really surprised to hear that almost every young person that came through the transportation area wanted to have an affordable car that could [one day] fit their kids in it.”

This event is the first of two that will occur with Huntington Bank in 2025. While the second event is still in its planning stages, Avalos hopes that it will build off what they learned from the first event.

“It’s very important for our youth to see the correlation of their treatment and how it’s going to impact their future after Mercy,” Avalos said.

On a recent Sunday morning, a group of our young people and staff ran through Grant Park and the streets...

April 11, 2025

Adorning walls throughout Mercy Home for Boys & Girls every February are portraits of African American trailblazers, from activists such...

March 27, 2025

While St. Patrick’s Day fervor in Chicago was turned up to full throttle on the day of the downtown parade,...

March 26, 2025

Comments